BXNK enables secure and instant settlement across fiat, stablecoins, and digital assets through its regulated infrastructure. Each use case operates on fixed currency pools and the atomic protocol , ensuring transparency, compliance, and predictable value transfer across global financial corridors.

Explore Use Cases

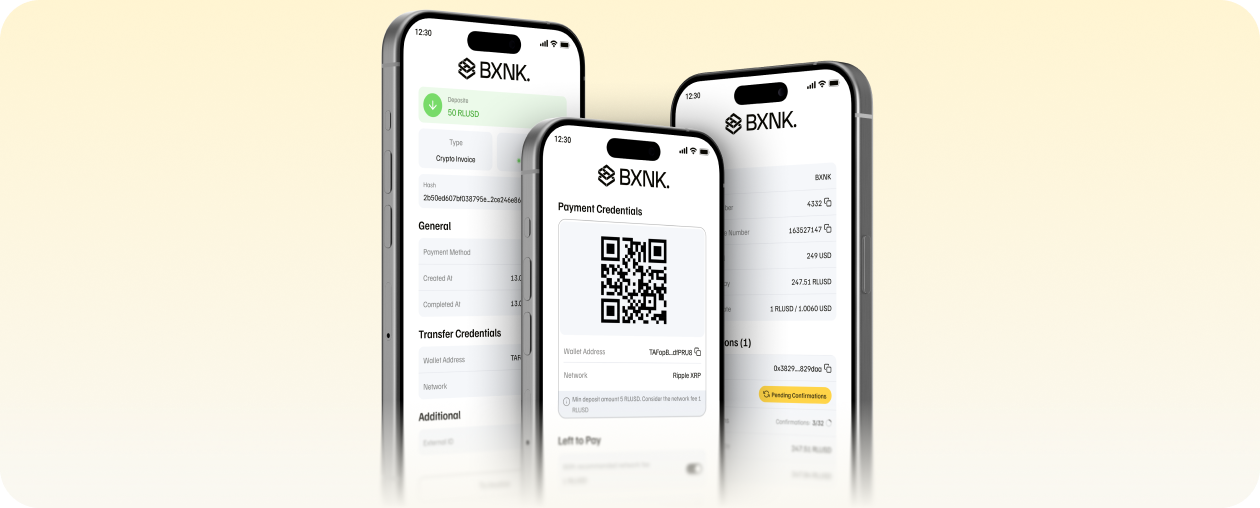

BXNK streamlines how traditional money enters the digital asset ecosystem. When a fiat payment is initiated, funds are deposited into a client subaccount within the respective fiat pool. Once compliance checks are complete, the atomic protocol issues a settlement instruction to release equivalent value from the corresponding crypto pool.

This happens in real time , no OTC dependency, no spread loss, and no manual exchange risk. Financial institutions, PSPs, and fintech applications can use this flow to offer seamless digital asset settlement and wallet top-ups without managing crypto custody or liquidity themselves.

BXNK enables instant and compliant conversion from digital assets to fiat without relying on traditional banking rails. When a user deposits crypto, the protocol validates the source wallet, runs AML and risk checks, and then releases funds from the designated fiat pool.

The payout lands immediately in the recipient’s account, with transparent transaction visibility end to end. This gives exchanges, on-ramps, and settlement providers a fast, regulated off-ramp that maintains full price certainty and liquidity availability for users worldwide.

.svg)

BXNK removes the delays and costs of the correspondent banking model by connecting currency pools directly. When a sender transfers AED and a recipient expects USD, settlement occurs from one fixed pool to another , no SWIFT routing, no intermediary banks, no FX spread. Transactions finalize instantly, maintaining full traceability and compliance oversight. For financial institutions, PSPs, and treasury operators, this unlocks cross-border transfers that move at digital speed while retaining the regulatory assurance of licensed financial infrastructure.

BXNK’s architecture is chain-agnostic, supporting seamless movement of CBDCs and stablecoins alongside traditional fiat currencies. Transfers are executed using the same atomic protocol, ensuring identical compliance validation, auditability, and risk management across every asset type. This creates a bridge between regulated digital currencies and existing financial systems , allowing banks, regulators, and fintechs to integrate digital settlement capabilities without introducing operational risk or compliance gaps.